A brive history of money

Money has been one of the most important inventions of humanity at least as important as the invention of the wheel. It is commonly defined through the definition of these three principles as :

-A medium of exchange

-A store of value

-A unit of account

Money has evolved a lot over the ages from various commodities to precious metals such as gold and silver, which have been the most widely used in human history. It was then slowly replaced with fiduciary money such as banknotes and then by scriptural money, which has no longer physical support. It is estimated that the money supply is now composed of 90% scriptural money and 10% cash.

Even though the means of payment are evolving very quickly in recent years with the democratisation of credit cards, internet accounts such as PayPal and mobile payments using a smartphone. Traditional money hasn’t evolved since many years, the “core” of money remains the same : some data stored in datacenters and ledgers of banks.

The first revolution came in 2009 with Bitcoin, which created a decentralized online payment system and its currency, bitcoin, which can be compared to a form of “digital cash”. It was followed in 2015 by Ethereum, which was originally intended to be an upgrade of the Bitcoin protocol to allow it to run smart contracts that make the currency programmable and which has finally become an independent network.

Intergovernmental agencies have been sceptical about cryptocurrencies, but seeing the rise of stablecoins on the “cryptosphere” they became interested in the underlying technology of distributed ledgers and programmable currency. In 2018, former IMF president Christine Lagarde said that state-backed digital currencies could enable fast, secure and cheaper international transfers.

That marked the beginning of CBDC projects all over the world. Now we estimate that 60% to 80% of central banks have started working on CBDC projects.

Are CBDCs cryptocurrencies or stablecoins ?

Cryptocurrencies were founded on the principles of decentralization by being publicly distributed, with full transparency on the transactions and how the network operates, its safety is guaranteed by advanced cryptographic techniques. CBDC looks very similar to the actual stablecoins and more specifically to fiat-backed tokens where the central banks replace the role of the companies.

However, unlike cryptocurrencies such as bitcoin the underlying asset of CBDC will not be a “crypto-asset” but central bank’s fiat currency, they might use distributed ledger technologies, but it will be private, permissioned and not decentralized as it will be under the management of the central banks, that’s why we’re more likely to call them “digital” rather than “crypto” currencies.

So if CBDC aren’t “crypto” how different is it from actual fiat currencies ?

The current financial system uses SWIFT (Society of Worldwide Interbank Financial Telecommunication) to send financial information such as money transfers or even society shares, this system has not much evolved since its creation, to make a transfert there is two possibilities :

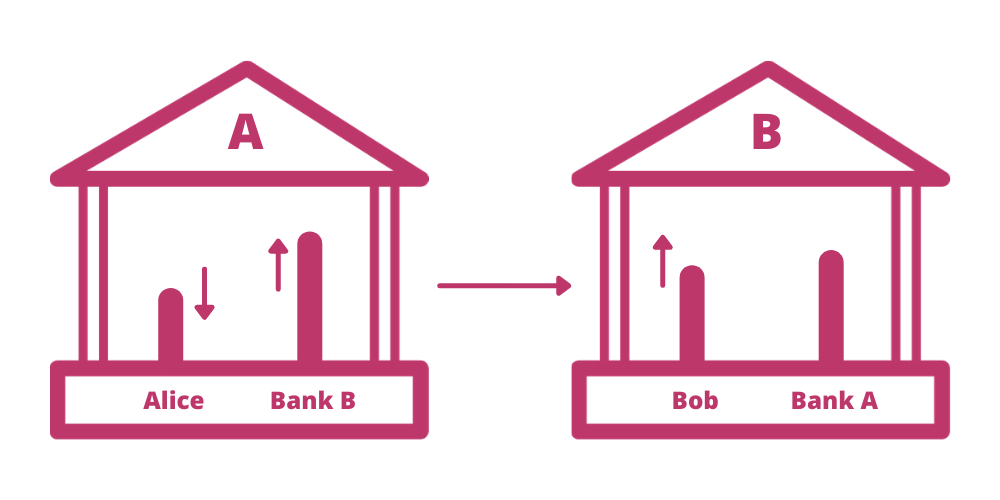

-Banks are in a direct relationship, where each bank owns a commercial account in the other; when a bank sends a SWIFT message to the other, the receiver adjusts the account of the sender.

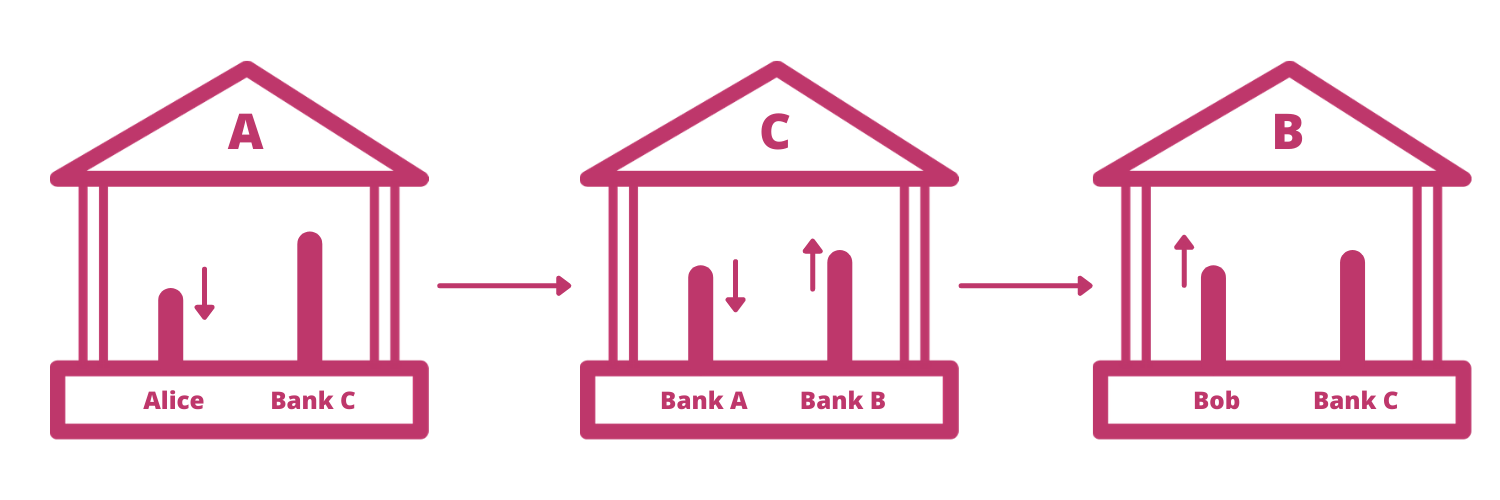

-Banks aren’t in a direct relationship; to allow the transfer of funds, the system needs to find one or more intermediaries that share commun account to make it possible.

This leads to extra processing time and higher costs as intermediaries are getting commissioned for such operations.

CBDCs aims to make these transfers easier and faster by eliminating intermediaries in the process, a distributed ledger or even a system where accounts are held directly with the central bank could help a lot to reduce intermediaries and transaction costs. Users could enjoy cheap or even free instantaneous transactions. It could also bring new technologies to the money such as smart-contract or similar and more transparency on the financial system.

Do CBDCs have any disadvantages ?

Some people are concerned about the CBDCs as they can be used to slowly remove cash and the anonymisation it provides, depending on the privacy level central banks are willing to give to their users.

For example the People’s Bank of China (PBOC), which is one of the most advanced countries on its CDBC project, could use it as a new surveillance tool to have more control over the population.

The IFM also stated that CBDCs could lead to systemic risk during the transition from “traditional money” to CBDCs. Furthermore, it could be a danger for retail banks if they stop receiving deposits because of central banks taking over this part of their activity.

The development of CBDCs across the world :

China: As mentioned earlier, China is one of the most advanced countries on the subject, its CBDC called DCEP for “Digital Currency Electronics Payment” has been launched in several major cities in the country. Issued by the PBOC and distributed to individuals and businesses via intermediaries, the currency can be stored on mobile devices, and it is compatible with Alipay and WeChat allowing payment by QR code and NFC. An interesting feature is that the currency can be transferred offline and “peer to peer” without any intermediaries.

The DCEP is also partially anonymous but can be monitored or analysed by the PBOC, it can be a way to reinforce the social scoring system used to punish or reward the citizen according to their behaviour.

Sweden: The first country who tried a cashless society is also one of the most advanced on its CBDC “e-krona” the Riksbank has started to work on the e-krona project and has started experiments with internal use of DLT. However, retail banks have expressed some concerns about how the project will be launched and have asked to prepare legislation on e-krona.

Brazil: The country announced that the digital real should be ready for launch in 2022. It will be interoperable with the new “Pix” payment system, which allows QR code payment across the country.

Venezuela: The “Petro” has been launched to control the hyperinflation, it can be compared to an “asset backed” stablecoins as it should be backed by the value of a barrel of oil. However due to the lack of trust of the citizens in the government, the Petro is exchanged way under its theoretical value.

Europe: the ECB has declared to do research on a CBDC project that could lead to one or two CBDCs : one for institutions and a second for individuals and everyday uses, there is no information yet if they will share the same one or use two different types of currencies. Beside the ECB serval countries started their own experiment like in France where the Bank of France successfully conducted a first interbank settlement on a blockchain.

Most of the northern and developed countries have started to do research on the topic, so we can expect to see more and more experiments on the CBDCs around the world in the near future. CBDCs remain very different from the current crypto currencies, it may replace fiat-backed stablecoins if governments want to keep their sovereignty over their currencies but it could lead to convergence between traditional and decentralized finance.